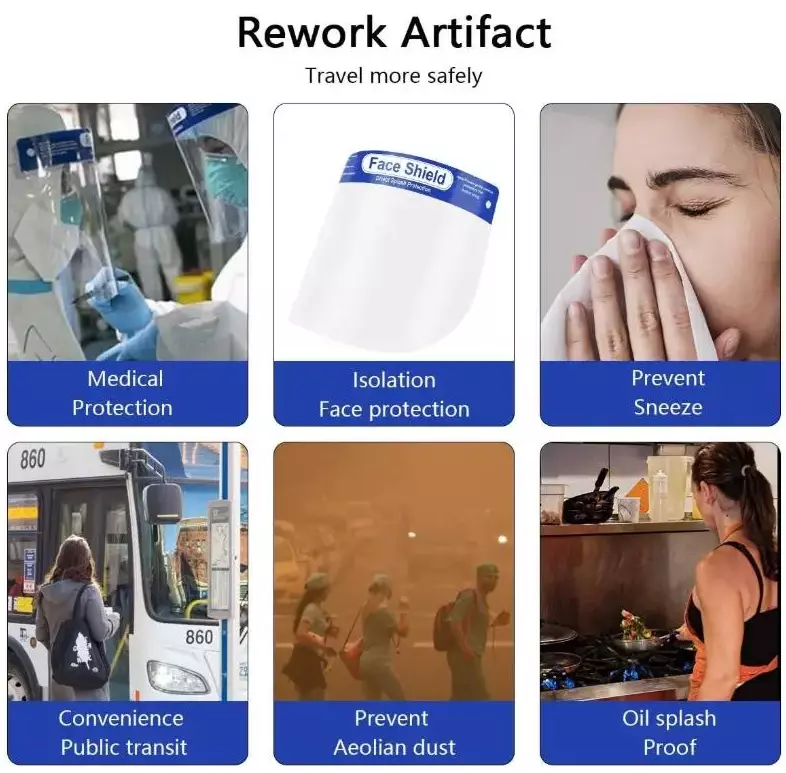

It is a new product suitable for our daily life ,plastic face shield can be used in outdoor activities to prevent damage to s caused by sun or air dust etc.A clear protective film on the surface prevent scratches.

Protective face shield is equipped with a transparent window, which can make the field of vision clearer.

The top of the protective face shields also has a soft sponge and an adjustable elastic band, which is more convenient for users to use. The disposable plastic face shield can be packaged individually or in a pack of 12 according to customer requirements.

The plastic protective film on the plastic surface must be torn off before use.

Product name: Protective Face Shield.

Size: 32*22cm/30*19.5 cm / Customized.

Color: Clear/ Customized.

Material: Double anti-fog PET sheet +sponge + elastic band

Sample: Freely

Sample time: 3-6 working days

Application

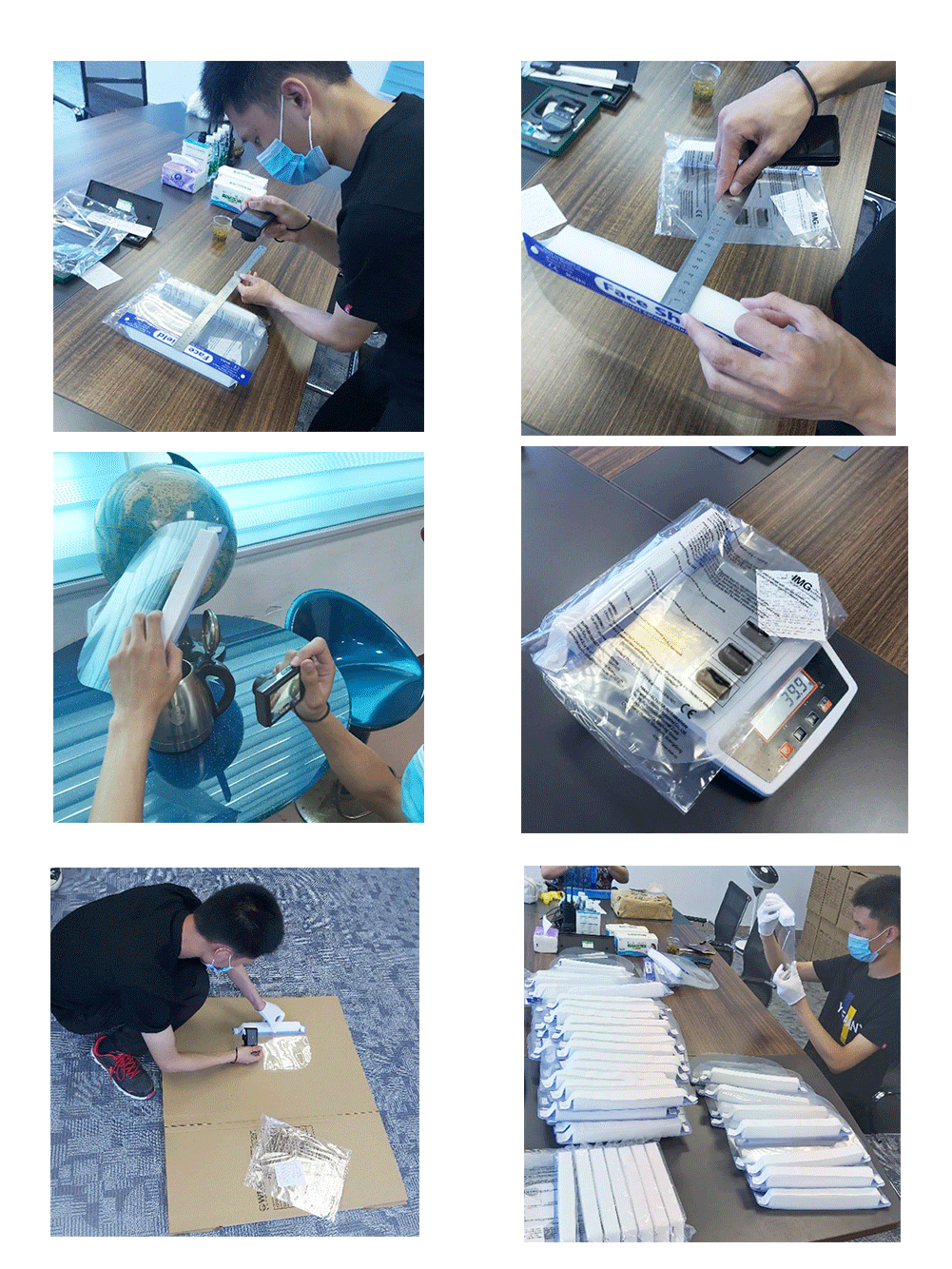

Quality test

Kids Face Shield,Disposable Plastic Face Shield,Pet Face Shield,Anti-Fog Face Shield Shenzhen Stardeal Industrial Co.,Ltd , https://www.plasticblisterpack.com

Alliance is not easy to "combine" At present, the alliance formed by all liner companies is in various forms, and the cooperation focus is undoubtedly the launch of a daily flight service similar to "Daily Maersk" (hereinafter referred to as "Daily Class"). The author believes that although the alliance is easy to form, the difficulty of launching a daily class is not small.

A coalition is a combination of several daily classes, such as ABC three ship company cooperation, A every Monday, Thursday, Sunday, B every Tuesday, Friday, C every Wednesday, Saturday, each in Shanghai Port opened A boat, in the form of interchangeable seats, allows each family to remove the customer's box at the port every day. The difficulty lies in: In the above example, each company needs to invest more than 20 ships on average, and each vessel should have a capacity of more than 8,000 TEU. Only a company with a large scale can provide so much capacity. If four or five companies are involved, although the number of vessels each invested will be greatly reduced, there will be more conflicts of interest among the various companies. For example, each family has its own container source, a firm port, and it is difficult to uniformly hang the port. If there is one port in one port and one port is not unified, there will be no complete classes; and each has its own self-employed. Or a co-operating terminal, if only berthing a company’s terminal, one will benefit, and the others will be almost idle. If each dock is used, the owner’s box is spread over several terminals. It is also possible to sail only in an empty cabin. If there is a full-loaded container on the same day, then the unfinished box must be transferred to another terminal immediately before it can be carried away on the next day. Otherwise, it may delay for another week. It is not a complete day-to-day class. These difficulties are not insurmountable. It takes a lot of energy to coordinate with each other and it takes a long time to balance and match. In fact, as long as the transport capacity is sufficient and we do not overcome these difficulties, we can create "mixed" classes every day. However, the efficiency, efficiency, cost, and service quality will be far less than the "purity" of "Maersk Mavis".

The second form of alliance is that VSA is composed of daily classes, that is, several liner companies on Asia-Europe Railways jointly invest in ships of similar capacity to form a weekly shift, linking to unified ports and terminals, and the quota for each position is Allocate the proportion of each transport capacity. The difficulty is the same as the first form of alliance, and it is much more complicated. It is more difficult because there must be enough VSA weekly classes to form a daily class. If one company has enough capacity to participate in more than one of the seven daily classes, it can form one or two weekly classes independently, or it can participate in the daily classes in the first way, so it is more difficult for such alliances to form daily classes.

There is also a way of alliance is chartered seats, if a liner company only has 1 Asia-Europe line, only 1 day a week in a port with a boat to sail, it may lease other liner companies for the remaining 6 days A certain number of places in the port of departure can also be called daily classes. Even a non-vessel carrier, chartered at a port for seven days a week, can be seen as a daily class. It seems that it would be very easy to build a daily class to fight against "Maersk of Heaven," but its foundation is too weak to be easily destroyed.

There is a lot of information in the liner company alliance because of the difficulties. It is only in the G6 alliance that the G6 alliance has clearly announced that it will start providing the G6 every six months after the launch of the “Masquisky every day†(that is, in April of this year). The specific movements of other coalitions are rarely reported and it is normal that many of these difficulties will certainly require more preparation time.

The author believes that although it is quite difficult for the various alliances of the liner industry to build daily classes, it takes a long time, but it is not unaccomplishable. It is estimated that they will be able to form a daily class, and their “purity†may not catch up with “Maersk Mavis†every day, but it will be further improved. space.

The purpose of composing a daily class is to confront Maersk. If "mixed" classes are used every day, they will be shorter than Maersk and will not be competitive. The author believes that if the conditions are not mature, it is better to walk in steps, that is, to form the next day class, that is, to open 4 classes a week, and then gradually increase to the daily class until the conditions mature.

The war of attrition continues to escalate In June last year, the China Communications Daily published an article entitled "Eurasian Line: An Effortless War Quietly Started." The author agrees with this view and believes that this war of attrition is still ongoing, with scales constantly escalating and losses increasing. Even Maersk, with its savvy management and large-scale shipbuilding efficiency, could not avoid the consequences of the war of attrition. In the first half of last year, the company was still a maverick single-winner, but lost $320 million in the third quarter of last year. Also fell into the ranks of losses.

In this fierce competition, Maersk seems to take the initiative. However, if it continues to be consumed, the company may not be the big winner. If most of the 55-million container vessels and 26 8,000-10,000 TEU vessels delivered by liner companies this year will be put into the Asia-Europe line, the volume of this line will increase more slowly this year, coupled with soaring oil prices. Liner companies will all lose their strength in this long lasting war of attrition. Maersk cannot be left alone and its losses are not necessarily smaller than others.

What is the guild war? In fact, the overwhelming majority of large liner companies are reluctant to withdraw from the Asia-Europe line and continue to fight the war of attrition.

When the global economy is in its development period, the Asia-Europe Railways (including the Mediterranean Sea) is one of the world's most high-liner liners, and the westernmost region is the most concentrated region of the developed countries, namely the European Union countries. Its total GDP is slightly higher than that of the United States ranked first, while the eastern end is Among the most concentrated regions in emerging economies, among them, the four countries that are considered the engine of global economic development, the second largest GDP in China, and the rapidly growing one in India, together with the “four little Asian dragons†and the third largest GDP in Japan. . In addition, in the middle of the east-west side, there are many oil-rich countries in the Middle East and the Mediterranean. Therefore, there are views that the Asian-European line is a battleground for the military in the liner industry. Therefore, the major liner companies will never give up this treasure, and Maersk should not let Asia-Europe alone.

It is also an important factor in the war of attrition that it is impossible to make 10,000-piece ships useless. The 10,000-kilometer ship delivered has no choice but to invest in Asia-Europe. Well, if you have lost money, why not leave the boat idle? Drewry has repeatedly proposed to idle the ship as a solution to the dilemma of the current global liner industry. Industry insiders also called out loudly, but companies are waiting for others to idle capacity and are still planning to expand their market share.

Another reason is that it is difficult to withdraw. When an industry is in its early stage and development stage, there are few market entrants, and its profits are often very high. However, high profits attract capital for the pursuit of profit as a source of capital, and industry profits are also becoming more and more due to excessive competition. This is also true of the current fierce competition in the liner industry. At this time, there are two alternatives for general companies. One is to withdraw and to invest in a more profitable new industry. The second is to increase competitiveness and stick to it. Due to the large amount of assets invested by liner companies, it is difficult to withdraw from them and it will be difficult to return if they withdraw. There have been relatively large liner companies that retired when the market came to an end. However, most of them are difficult to withdraw. Especially those who have a strong backing will not easily withdraw, so they choose to continue fighting. Go on.

When will this war break? So when will the long-lasting war of attrition end? The answer is difficult to give, but it may ease as the liner market improves. However, there are many opinions about when the liner market will improve. One argument is that until 2013-2014, one argument is that the economy of Europe and the United States will continue to improve after a steady improvement. Another argument is that until most of the big liner companies cannot sustain themselves in the war of attrition and start idle capacity, they will only get better. Another answer is that if the price of oil soars and continues to be high, the liner companies will implement a greater rate of deceleration and fuel economy again in spite of opposition from the cargo owners. This will partially relieve the chronic problems of overcapacity and will improve.

It is by no means a good thing to fight a war of attrition. All parties may be seriously injured. The author appeals that all relevant liner companies should not fight a war of attrition and should actively coordinate their operations to jointly co-ordinate transport capacity to enhance the market. At the same time, no longer blindly expanding its capacity, actively dismantling old ships and uncompetitive ships, at this time, only the shipowners can rescue the shipowners and shipowners should take active action.

□Viewpoint: “Asia-Europe is currently mainly responsible for the heavy transport of large container vessels. By the end of this year, the 10,000-tank container will increase by 20%. However, as transport capacity continues to invest in Asia-Europe, the transport volume is not sufficient. As growth echoes, the new combination (Alliance) is in the form of a form that will not help with the increase in freight rates." - Paris Alphaliner "The new Super League has no help in reducing capacity and raising freight revenue. This is a two different nature. The urgent needs of the shipping industry are not these.†– Zhao Bingxi, an analyst with Seoul-based Kiwoon Securities Co. “The super coalition should at least reduce the growth of future capacity in the Asia-Europe Union, rather than desperately increase the number of ships. If you want to increase capacity through the alliance and invest in new ships, the cooperation between partners will only be more difficult. Whether the shipping companies have thought that the alliance must also have the iron discipline and eliminate cut-throat-style price wars." - NH Investment and Investment in Seoul Securities analyst Analyst Shin Hyun-seo followed Maersk: "Daily Maersk" is operating normally. (Reporter Jiang Qiuhua correspondent Huang Hui) February 1st, Ma Shi Group issued a statement refuting reports Alphaliner statement and said, "Maersk every day" normal operation, it will continue to provide customers with quality and efficient services.

Alphaliner, a French shipping consultancy, said in its report for the fifth period in 2012 that “Daily Maersk†was reduced from seven days a week to six days. In response, Maersk Line stated that this statement is wrong. The reason for this "error" is that the co-departmental agreement between Maersk Line and CMA on the AE8 route will expire this month. In fact, this does not affect the normal operation of "Maersk Mavis". Maersk Line said that “Daily Maersk†goes from the main port of China to the main port of Europe and has the same interception cut-off time seven days a week. Each booking, as long as the date of cut-off date for the anticipated delivery, can be a fixed transport time commitment. There is no change in this concept. The "Daily Maersk" is functioning normally and will continue to provide services to customers.

â–¡Background Banyan Industry Alliance and Great Alliance+New World Union December 20, 2011, members of the Great Alliance Japan Post, Hapag-Lloyd and OOCL, members of the New World Alliance Mitsui, the modern merchant ship and the merchant ship Mitsui announced, Will jointly open a new Far East - Europe route. This made the Great Alliance and the members of the New World Alliance join forces to establish a new Far East-European Union (also known as the G6 Alliance). The new alliance plans to start operation in April 2012, with 7 Asia-Europe routes and 2 sub-regional routes. The nine joint routes with more than 90 vessels will provide more frequent liner services between major ports in Asia, Europe and the Mediterranean. Alliance members stated that the new alliance will have a faster transportation speed, and the wider port will cover and deploy the latest type of 14,000 TEU container ship. The new alliance will integrate the largest container ships in the next 30 months.

Mediterranean Shipping + CMA Crew at the end of 2011, Mediterranean Shipping and CMA CGM announced that they will become operating alliances. According to the agreement, the scope of business cooperation between the two parties will cover multiple routes, including Asia-North Europe, Asia-South Africa and all South American markets. If operations are successful, the scope of cooperation may also extend to other routes. It is reported that both Mediterranean Shipping and CMA CGM have insisted that the cooperation only includes the sharing of ships or the exchange of accommodations. The agreement neither involved joint sales and marketing nor involved joint pricing.

CKYH-Green Alliance + Evergreen Since the second quarter of 2012, CKYH-Green Alliance and Evergreen will strengthen cooperation in Asia-Northwestern Europe and Asia-Mediterranean routes to further enhance Asia-Northwestern Europe and Asia-Mediterranean routes. Service frequency, shorten delivery time, and expand direct coverage.

COSCO Container Lines + CSCL COSCON and CSCL will deepen cooperation in 2012 to expand the fare interchange between the Far East-Europe route and the Far East-Mediterranean route.

After the launch of “Maersk of the dayâ€, it triggered a strong rebound in the market, making the fiercely competitive Asian-European line even more intense. Industry insiders called on all related liner companies not to fight a war of attrition. They should actively coordinate their operations and jointly coordinate transport capacity to enhance the market. Photo courtesy of Maersk Line In October of last year, Maersk Line officially launched “Maersk Mavis†on the Asia-Europe Railway Line. This innovative and innovative service immediately sparked a wave of waves. The competitive landscape of the liner industry has undergone fierce changes. The large-scale liner companies have redefined their business strategies and set off a wave of alliance cooperation. At present, the four-nation alliance, including the Far East-European Union (G6), is facing a fierce battle with leading Maersk Line. Then, what are the difficulties in the cooperation of these alliances and what opinions do they have in the industry? What are the implications? This newspaper has launched a set of manuscripts, so stay tuned. - Editors â–¡ Observing the prospects of the liner industry alliance Conjecture Anhai "Daily Maersk" sparked a strong confrontation In September last year, Maersk Line announced that it will launch a "Daily Maersk" brand new service on the Asia-Europe Railway Line. That is, 7 days a week, there will be a boat every day. If you call at the port, you will be fined if you do not arrive at the port of destination on schedule. With this move, it is expected that a large number of containers may continue to flock to the Maersk quay from various sources, which will cause extremely heavy blows to other liner companies. At that time, in response to “Maersk of the day,†there were people who had warned in the media: “If a liner company has to respond at the moment of its survival, it can't estimate what kind of response measures it is.†One stone sparked a wave of waves. After the launch of "Maersk of the day", it caused a strong market rebound. Up to now, among the top 20 liner companies, there have been two medium-sized liner companies withdrawing from Asia-Europe and only one sub-ground. None of the other liner companies withdrew from the company (at least some capacity reduction), but instead formed alliances to form alliances against Maersk.